Extract Stock & Finance Data – Web Scraping Stock & Finance Data

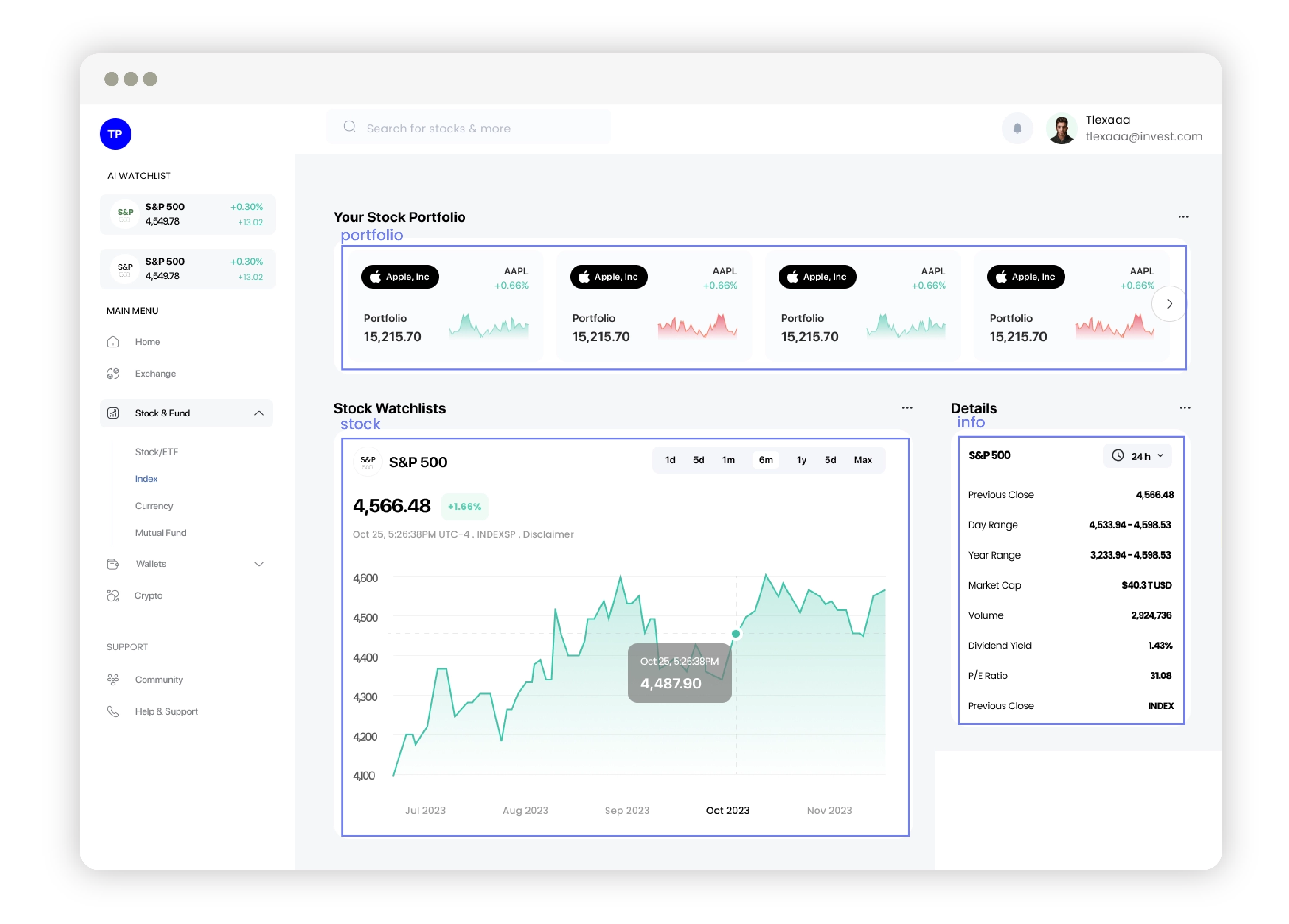

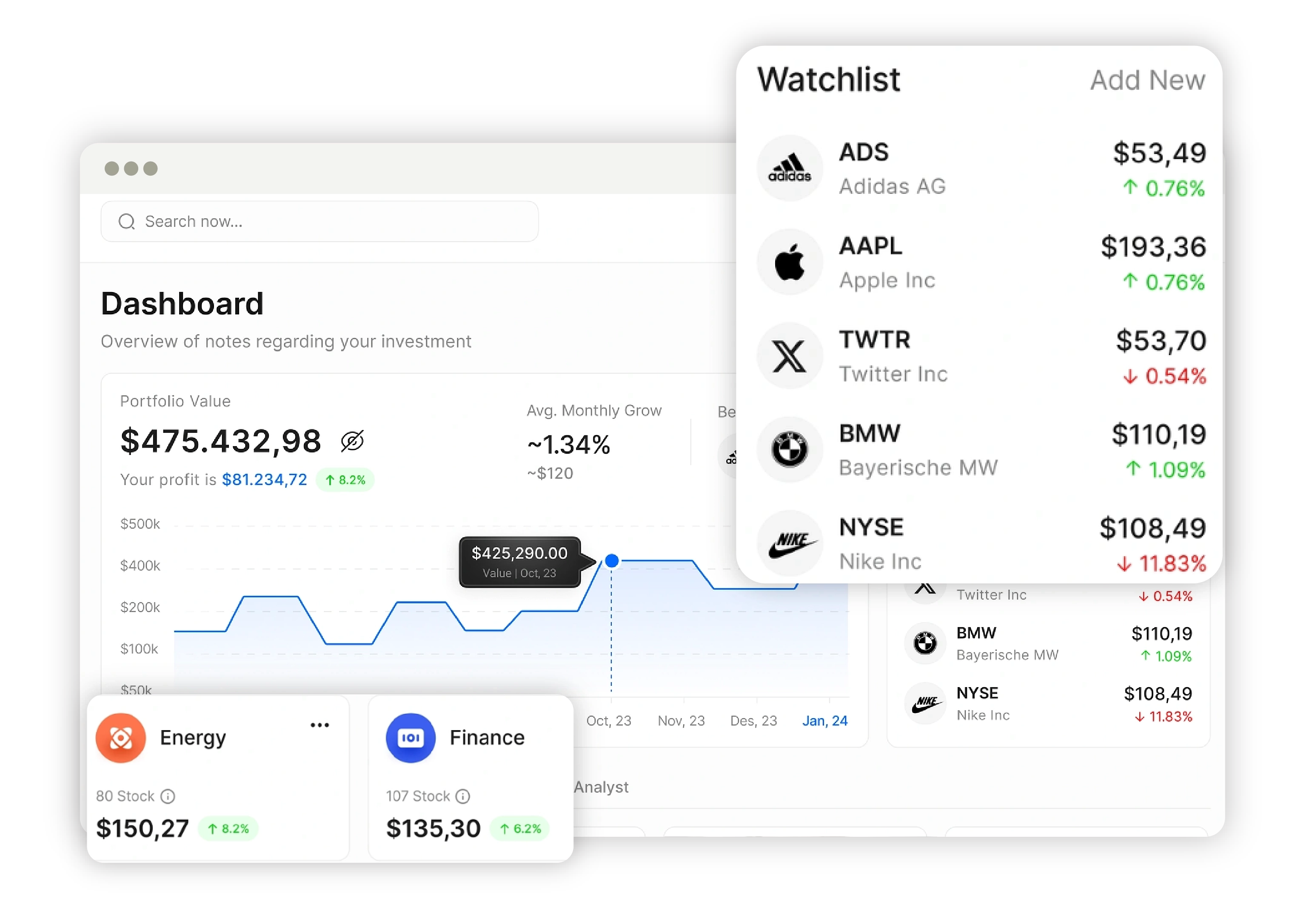

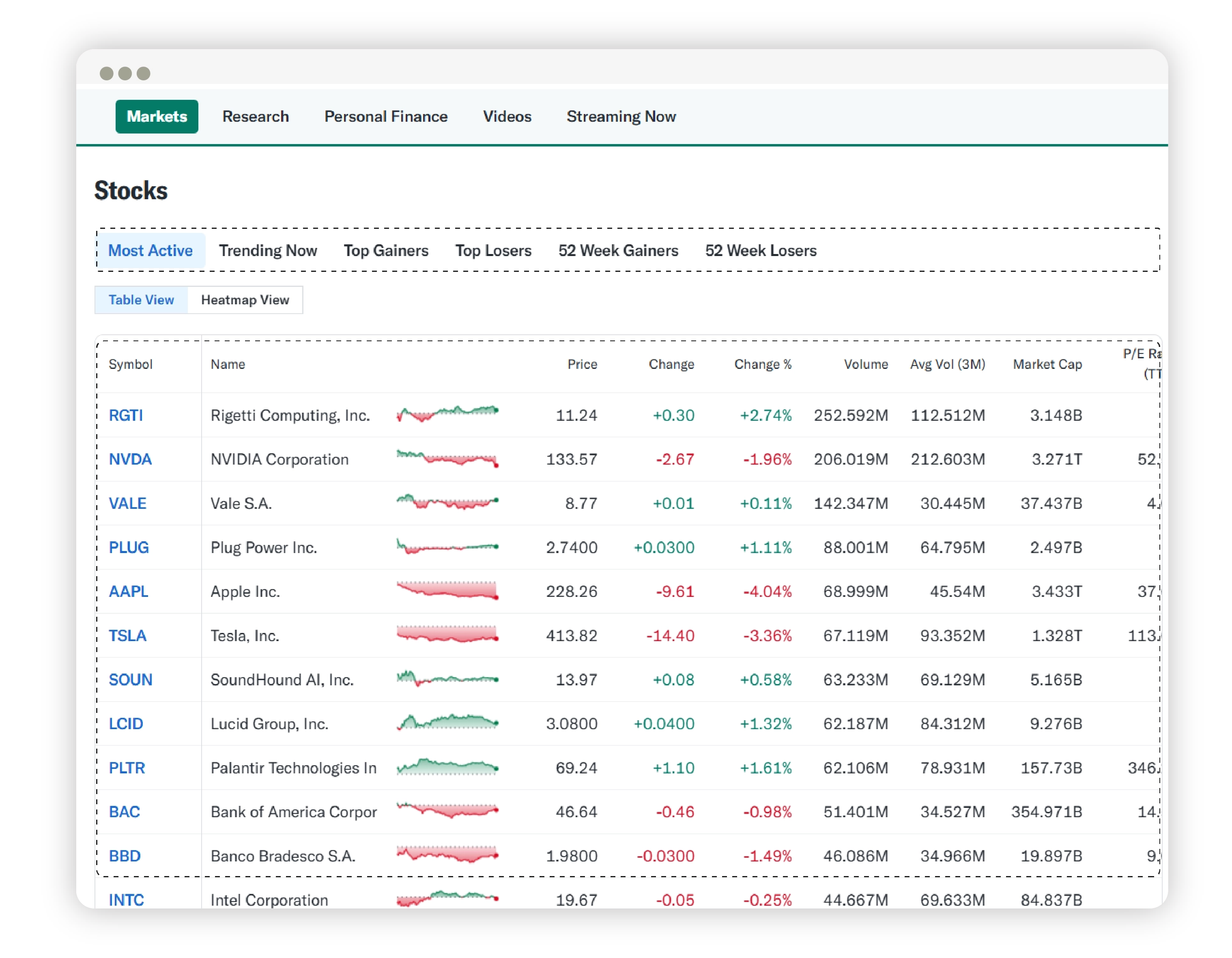

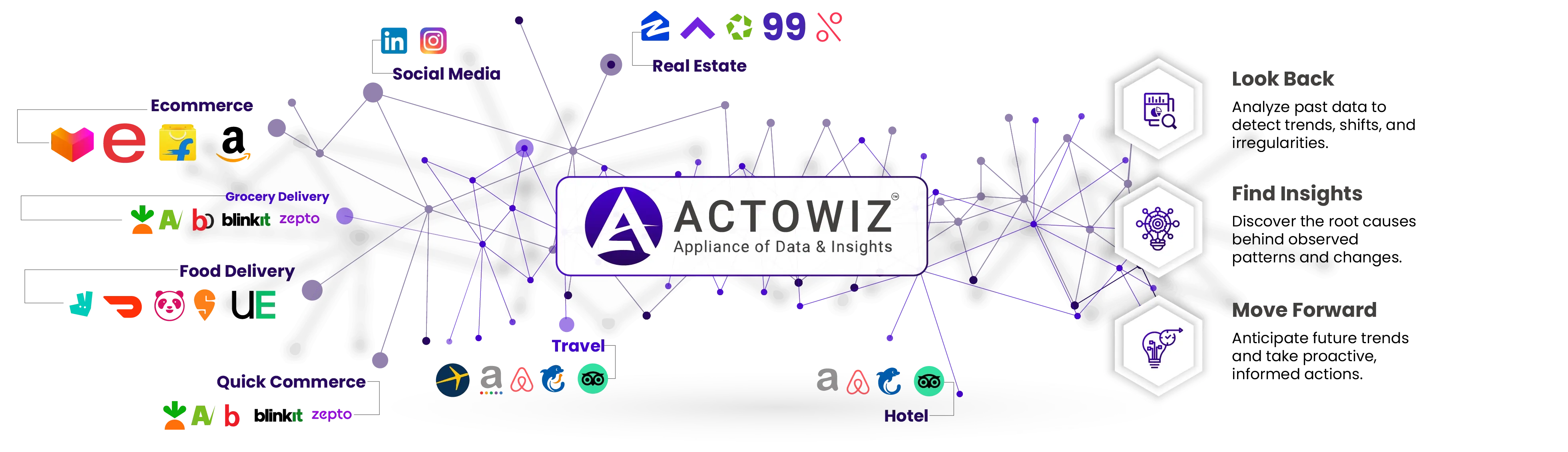

Actowiz Solutions offers comprehensive Stock Data Scraping Services, enabling businesses to access precise and up-to-date financial information. Our expertise lies in extracting Real-Time Stock Prices Data, helping clients stay ahead in dynamic markets. With our Finance Data Scraping solutions , you can gather essential insights into market trends, historical stock prices, company performance, and trading volumes.

Our advanced tools and techniques facilitate Stock Market Trends Scraping, allowing businesses to analyze market behavior and make data-driven decisions. Additionally, Actowiz Solutions provides a robust API for Stock Data Scraping, ensuring seamless integration with your systems to fetch real-time or historical data effortlessly.

We specialize in extracting stock and finance data across multiple regions, including the USA, Australia, Japan, Canada, UK, UAE, Italy, Germany, China, Switzerland, India, Qatar, Macao SAR, Luxembourg, Austria, Singapore, Denmark, Ireland, and Norway. Our tailored solutions cater to various industries, such as banking, investment, and financial analytics, ensuring accurate and reliable data delivery.

Partner with Actowiz Solutions to unlock the potential of financial data and achieve a competitive edge in global markets. Let us simplify your journey to actionable insights with our cutting-edge data scraping services.